salt tax impact new york

About 10 percent of tax filers with incomes less than 50000 claimed the SALT deduction in 2014 compared with about 81 percent of tax filers with incomes exceeding 100000 the Tax Policy. And some lawmakers have been fighting to include a.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

4 hours agoDozens of House Democrats from California New York and New Jersey have spent years arguing that the limits on the state and local tax deduction known as SALT included in the 2017 Trump administration tax cut package amounted to a big tax increase on middle-class families in areas with either high real estate prices high state and local.

. 52 rows States with high income taxes account for most SALT deductions. Much has been said and written about the corporate tax reform measures and their potential impact on various taxpayers. For example in 2017 the average SALT deduction in New York was 23804 compared to just.

Cuomo repeatedly has claimed that the SALT cap is costing New Yorkers up to 15 billion a year in higher federal taxes. It appears one of the goals of this legislation was to improve the. 11 rows New York Taxpayers.

The cap disproportionately impacts expensive high-tax Blue States including New York where its exacerbated the effect of. With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on the same income Nadler said. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000.

Unchanged is the SALT state and local income tax deduction cap. 23 hours agoRemember how House Democrats from New Jersey and New York vowed to oppose a tax-and-spending bill that didnt lift the 10000 deduction limit for state-and-local taxes. The states tax code and estimated the fiscal impact of SALT on New York taxpayers.

However the other beneficiaries of the SALT deduction are high tax states such as New York California New Jersey and Illinois. The department estimated that in one year New York State households would pay an additional 123 billion in personal income taxes and the SALT cap could cost taxpayers. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at rates of.

Dozens of House Democrats from California New York and New Jersey have spent years arguing that the limits on the state and local tax deduction known as SALT included in the 2017 Trump administration tax cut package amounted to a big tax increase on middle-class families in areas with either high real estate prices high state and local taxes or both. Apply to Senior Tax Associate Senior Associate Engineer Tax Staff and more. The current maximum individual tax rate in New York is 882 percent.

Each respective proposal includes the same three new tax rates985 percent 1085 percent and 1185 percentbut imposes such rates at differing income thresholds. Residents of New York take the highest average deduction for state and. With a SALT deduction in place as states and localities increase taxes the deduction becomes more valuable for itemizers.

The new brackets and rates would be effective for the 2021 tax year. Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey. Almost 11 million taxpayers are likely to feel the pinch of a new cap on deducting state and local taxes also known as SALT deductions.

Financial Consultant Financial Services Tax Manager. The New York executive budget legislation for fiscal year 20142015 was signed by Gov. The 10000 limit on the amount of state and local taxes deductible from federal income was enacted in 2017 and sunsets after 2025 under current law.

Job in New York City - Richmond County - NY New York - USA 10261. Andrew Cuomo on March 31 2014. As counterfactuals go that approach is purest.

Repealing the SALT limitation is a question of fundamental fairness. Sarah McGahan JD LLM. In particular California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT deductions.

State Local Tax SALT Editor. Before President Donald Trump signed the Tax Cuts and Jobs. This number apparently is an estimate of the amount New Yorkers would now be saving if the SALT deduction had been preserved in combination with all of the other tax cuts featured in the TCJA.

New York made up the next highest percentage of national SALT deductions at 13 of all deductions. The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial.

1940 Country Store Gas Station Melrose Louisiana Old South Etsy Gas Station Old General Stores Old Country Stores

Pin By Ashutosh Dodamani On Amazing Nature Amazing Nature Golden Gate Bridge Golden Gate

Ast Week The United States Fish And Wildlife Service Which Is Part Of The U S Department Of The Lake Michigan Chicago Indiana Dunes State Park Indiana Dunes

Jayson Bates On Twitter Beautiful Places To Visit Cool Places To Visit Places To Visit

San Francisco S Painted Ladies In The Alamo Square Neighborhood Is One Of The Most Photographed Loc San Francisco Restaurants San Francisco Visit San Francisco

Large Chalice Vase Sm 179 10153

New Direction Designs For Breaktime Massage Pefect Hour Flyer Massage Therapy Wellness Massage Massage Benefits

Pin By Ashutosh Dodamani On Amazing Nature Amazing Nature Golden Gate Bridge Golden Gate

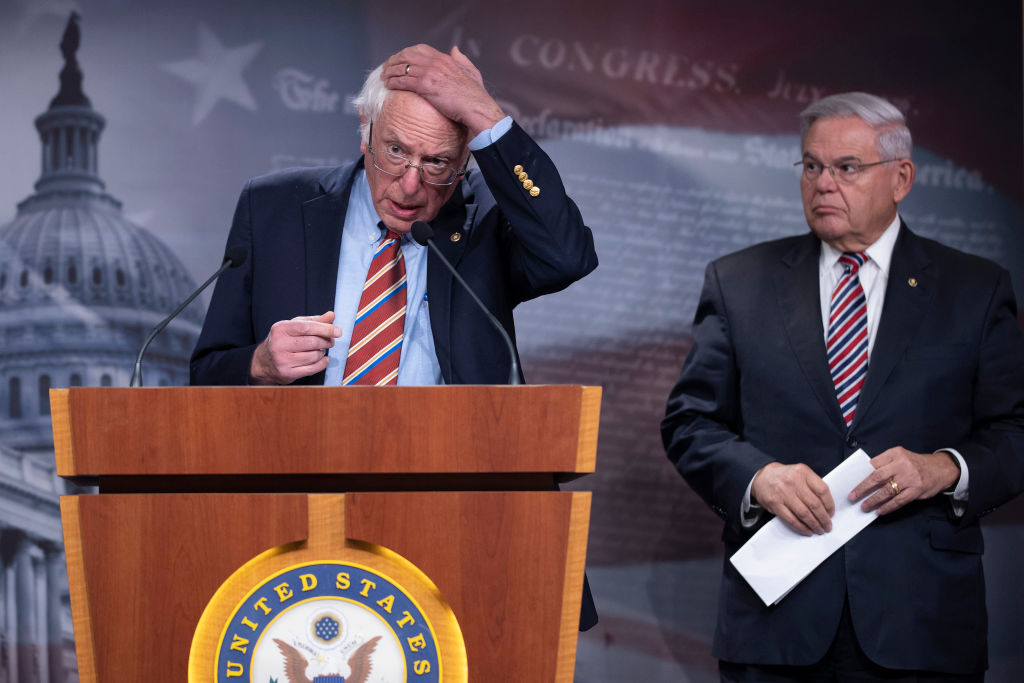

Why This Tax Provision Puts Democrats In A Tough Place Time

Bachelor Fans Think Kelley Flanagan Won Peter S Season After New Tiktok Theory Flanagan Chris Harrison Bachelor S

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Pin By Tami Mizrachi On My Books In 2022 Book Lovers Novels Books

Photo By Jason Chen Unsplash Taiwan Travel Singapore Travel Taipei

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Nyc Home Prices Plunge After Salt Deductions Capped

Mit Reopens Oculus Atop Great Dome Architecture College Architecture Classical Architecture